Earnest Student Loan Application – Earnest is an online provider of private student loans and loans to refinance existing student loans. They have also expanded their menu to include personal loans.

The entire loan process at Earnest is done online, so you can apply online and get a loan quote in just two minutes.

Contents

- Earnest Student Loan Application

- Earnest Loan Products Help Learners Fund Higher Education And Minimize Student Debt

- How To Defer Student Loans

- Student Loan Manager

- How To Refinance Student Loans

- What Is A Private Student Loan? A Quick Guide Earnest Blog

- You’re Requesting That I Upload Tax Documents For My Application. What Should I Provide? (tax Form Examples Shown)

- Low Interest Loans Designed For You

- Earnest Student Loan Refinancing Review

- The Pros And Cons Of Refinancing Student Loans Earnest Blog

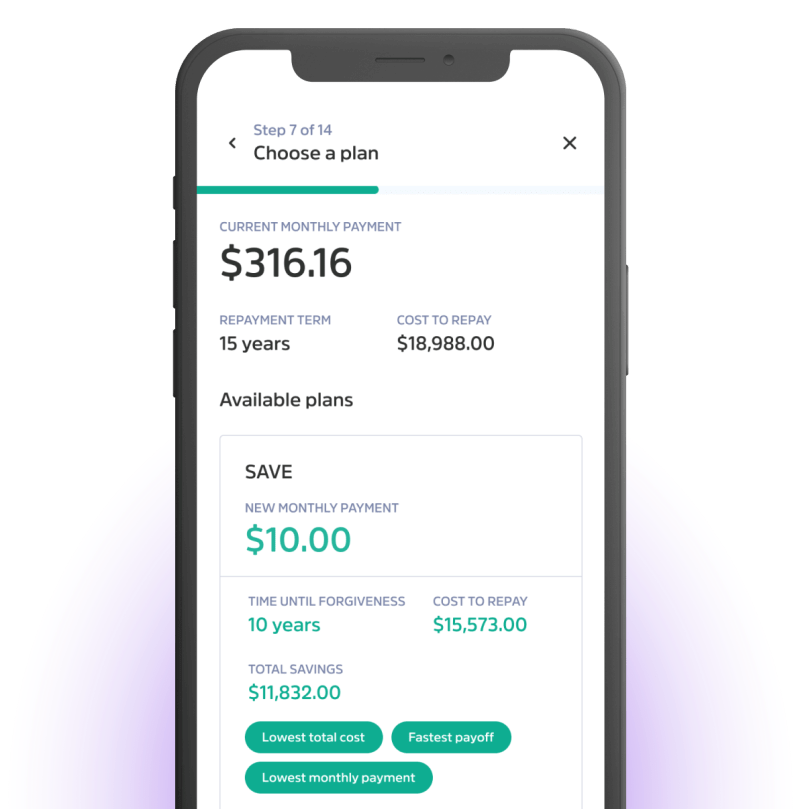

- Student Loan Forgiveness: If You Qualify, You Still Need To Apply!

- How To Take Out Student Loans Earnest Blog

Earnest Student Loan Application

In fact, private student loans are available for all levels of college attendance, including undergraduate and graduate schools, as well as business, medical, and law schools.

Earnest Loan Products Help Learners Fund Higher Education And Minimize Student Debt

Founded in 2013 and based in San Francisco, Earnest is a team of design, math, finance and technology geeks working together to overcome what they perceive as a lack of trust in the financial system.

In the process, they created a company that combines data analytics, streamlined design and exceptional service to offer a fast, low-cost and hyper-personalized financial experience.

The company provides private student loans to new students at all levels of the higher education process, and also refinances existing student loans.

They have also expanded into personal loans, which are unsecured loans that can be used for almost any purpose.

How To Defer Student Loans

The company has an A+ rating, which is the highest rating on the Better Business Bureau’s A+ to F scale.

Minimum and Maximum Loan Amount: $5,000 to $500,000 Funds can be borrowed to partially or fully refinance current student loan debt up to the maximum loan limit.

Minimum credit score required: 650. The higher your score, the lower your interest rate will be. All current student loan accounts must be in good standing and you must be current on your rent or mortgage payments. Your credit report should not reflect bankruptcy or accounts recently submitted to collections.

Qualifications: In addition to your credit score, Earnest also considers your savings, education and earning potential to calculate your interest rate. There are no maximum income requirements and no debt-to-income ratio is disclosed.

Student Loan Manager

Eligibility: You must be a U.S. citizen or permanent resident alien, have graduated from college and be employed, or be within six months of graduation with a promise of employment, which must be submitted with your application.

Allowed Co-Signer: Co-signers cannot refinance a student loan. You must qualify based on your credit profile and financial resources. Additionally, no co-borrower can be added to your loan application, even if that person is your spouse.

Student Loan Refinance Referral Program: Both you and the person you refer will receive $200 when they refinance their student loans with Earnest using your personal link or referral code. The referral program is only available for student loan refinancing, not for private student loans or personal loans.

Mobile: They don’t currently have an app, but the site is mobile-optimized so you can easily use it on your phone.

How To Refinance Student Loans

Customer Service: Available by phone, live chat or email, Monday to Friday, 8:00 a.m. to 5:00 p.m. Pacific time.

Prepayment – You can skip one payment every 12 months, but you must make at least six subsequent repayments on time, and your loan must be in good standing.

Forbearance – available in the event of involuntary loss of job or reduction in income, significant increase in costs necessary to support a home or family, or unpaid maternity or paternity leave. You will be eligible for 12 months of forbearance, although simple daily interest will continue to accrue on the loan.

In the Military – Earnest offers military benefits and SCRA benefits to eligible service members (limits interest rate to 6%).

What Is A Private Student Loan? A Quick Guide Earnest Blog

Loan forgiveness and loan repayment – the loan will be repaid in the event of death or total and permanent incapacity for work.

Interest Rate Reduction Program – You may qualify for a reduced interest rate for up to six months, which will lower your monthly payment.

Earnest does not charge origination fees, prepayment penalties, or early or late payment fees. The only direct fee they charge is up to $8 and covers the costs assessed by any financial institution in processing the returned payment.

However, they warn that Florida residents are subject to a stamp duty of 0.35% of the amount borrowed (for example, $35 for a $10,000 loan, $350 for a $100,000 loan).

You’re Requesting That I Upload Tax Documents For My Application. What Should I Provide? (tax Form Examples Shown)

Interest rates range from 2.44% to 5.79% APR for fixed rate loans and from 1.88% to 5.64% for variable rate loans.

Minimum credit score requirement: Same as student loan refinancing. Co-signers must have at least three years of credit history, with no bankruptcy history on their credit reports and no current accounts.

Eligibility: You must be a U.S. citizen or permanent resident alien and attend a college or university accredited by the U.S. Department of Education under Title IV.

Loan terms: 5, 7, 10, 12 or 15 years with cosigner loans or 5 or 7 years without a cosigner.

Low Interest Loans Designed For You

Co-Signer Waiver: Earnest does not offer a co-signer waiver. Those signing the agreement must remain on the loan until it is fully repaid.

Customer Service: Available by phone, live chat or email, Monday to Friday, 8:00 a.m. to 5:00 p.m. Pacific time.

Economic Hardship Forbearance: The same forbearance programs available for student loan refinancing are also available for private student loans.

The fee structure for Earnest private student loans is the same as for student loan refinancing.

Earnest Student Loan Refinancing Review

They don’t publish interest rates, but rates on all six private student loans start at 3.49% for fixed loans and 1.24% for variable loans.

Earnest does not provide personal loans directly, but instead offers them through a partnership with Fiona. Fiona is an online lending platform that helps you find the personal lender that best meets your needs.

Personal loans are completely flexible types of loans. You can borrow large sums of money that can be used for almost any purpose (except student loans). Moreover, the loans are completely unsecured and have a fixed interest rate, payment and repayment period.

If you are interested in a personal loan, you will click on the link on the Earnest website and you will be taken directly to Fiona’s website. There, you’ll complete a short online application to receive quotes from as many as eight personal lenders, some of which are among the biggest names in the industry.

The Pros And Cons Of Refinancing Student Loans Earnest Blog

The advantage of an online marketplace is that you can get competitive deals side by side. Armed with this information, you can choose the personal loan that is best for you.

Interest rates and fees: Interest rates can range from a minimum of 5.99% to a maximum of 35.99%, depending on your credit profile. None of the lenders participating on the Fiona platform charge an application fee. However, some charge a processing fee ranging from 1% to 6% of the approved loan amount, which will only be paid when the loan is approved and accepted. There are usually no prepayment penalties.

Minimum credit score requirements: These vary by personal lender, but the higher your score, the lower your interest rate will be.

Qualifications: Varies by lender, but you’ll need to be permanently employed with a predictable income that comfortably covers your current housing payments and debts, as well as the repayment of the new loan.

Student Loan Forgiveness: If You Qualify, You Still Need To Apply!

Allowed Co-Signer: Co-signers cannot take out personal loans. You must qualify based on your credit profile and financial resources. Additionally, you cannot add any co-borrower to your loan application, even if that person is your spouse.

You must be a U.S. citizen or foreign national living in the District of Columbia or one of the 47 states where Earnest lends. A resident alien must have a ten-year, unconditional alien permanent residence card. If you are applying for a private student loan, you must be at least 18 years of age or the age of majority in your state of residence unless you have a co-signer on your application.

For both student loan refinancing and private student loans, the college or university you attend or have attended must be accredited by the U.S. Department of Education under Title IV, and attendance must lead to or lead to a degree.

When completing your loan application, you will need to link your financial accounts to your Earnest application. This will give Earnest read-only access to your financial transactions. In this way, Earnest reviews your financial accounts and makes any calculations it deems necessary to process your application.

How To Take Out Student Loans Earnest Blog

Eligible financial accounts on your application must be domiciled in the United States and have balances in U.S. dollars. Accounts included include checking and savings accounts, retirement accounts, or investment accounts. Joint accounts are eligible for consideration, but must only receive credit for one-half of the account balance.

In some cases, Earnest may ask you to send a copy of your most recent tax return. Qualifying income must be documented from stable and verifiable sources. Ernest makes sure you earn more than you spend and that your income is high enough to cover your current debt and the new financing you are requesting. Your rent or mortgage payment will be included in your total debt. Even if your current mortgage payment is zero, Earnest will assume that the situation may change over the life of the loan and will take this into account in the underwriting process.

Qualify

Earnest student loan login, earnest student loan refinance, earnest student loan refinance reviews, earnest student loan refinance reddit, earnest student loan consolidation, earnest student loan refinancing, earnest student loan forgiveness, earnest student loan, earnest student loan refinance rates, earnest student loan review, earnest student loan rates, earnest private student loan