Defaulted Private Student Loan – One of the biggest challenges facing the American economy is the increase in student loan debt. According to the Federal Reserve Bank of New York:

With this level of debt we naturally see an increase in the level of default on these loans. According to the New York Fed, 28% of students who left college in 2010 and 2011 defaulted on their loans within five years. This compares to a standard rate of 19% for those who left school five years earlier.

Contents

- Defaulted Private Student Loan

- Defaulting On Student Loans: What You Should Know

- Average Student Loan Debt

- Student Debt Payback Lags

- Delinquency Vs. Default: What’s The Difference?

- Pros And Cons Of Student Loan Consolidation For Federal Loans

- Federal Vs. Private Student Loans: What’s The Difference?

- Exposing The Student Loan Racket (infographic)

Defaulted Private Student Loan

Last November, the Fed released an analysis titled “Who is Most Likely to Default on Student Loans?” In this post, we’ll summarize November’s analysis.

Defaulting On Student Loans: What You Should Know

The Fed’s study focused on people born between 1980 and 1986. It tracked their schooling and default student loan status by age. The survey asked five questions about student loan defaults:

The chart below looks at student loan defaults across six variables covering both private for-profit and public schools.

Next, the study looks at how degree status and program type are related to student loan defaults:

The premium paid for a four-year bachelor’s degree clearly pays dividends, especially in terms of minimizing the likelihood of defaulting on a loan.

Average Student Loan Debt

The final set of variables reviewed in this study was family background, specifically family income. Individuals were categorized based on the 2010 median income in the zip code in which they lived, resulting in two panels: those from areas with a median income above $55,000 and individuals from areas with a median income below $55,000.

Overall, attending a private four-year for-profit university is associated most with the likelihood of student loan default. Dropout is the second strongest variable related to default settings.

The long-term implication, of course, is that “life outcomes,” such as the ability to buy a home and also maintain a healthy credit rating, will vary greatly among student loan holders based on their educational choices and backgrounds. family. the government makes loans after a student or their family completes a FAFSA. The terms are mandated by law and include specific protections (such as fixed interest rates and income-based repayment plans) not normally associated with private loans. Unlike federal loans, private companies such as banks or credit unions make private loans. The lender has set terms and conditions for private loans. Private student loans are generally more expensive and offer fewer benefits and protections than federal student loans.

Federal student loan information can be found by going to www.StudentAid.gov. If you don’t know the name of your lender or servicer and can’t find your loan information on StudentAid.gov, you most likely have a private loan. You can find information about your private loan by checking your credit report.

Student Debt Payback Lags

All student loan information displayed on your www.StudentAid.gov account is federal loans. It is common for borrowers to have both federal and private loans. If you have a loan that does not appear on your www.StudentAid.gov account, it is important to check your credit report to find out who your private loan company is.

Federal loans have fixed interest rates that are usually lower than private loans. Private student loans can have variable or fixed interest rates. The interest rate on private student loans may be higher or lower than the interest rate on federal loans.

Only federal student loans have government-mandated repayment plans. If you have a private student loan and are struggling to make your monthly payment, you should contact your loan provider to find out about any repayment plans they offer. According to a report published by the Federal Reserve Board of Governors, 43 percent of Americans who attended college incurred debt for their education, 93 percent of which is in the form of student loans. Between 2006 and 2018, outstanding student loans tripled, and average annual college tuition increased by nearly $10,000 over the same period (

As of the first quarter of 2020, outstanding student loan balances were about $1.67 trillion, and private student loans made up about 8 percent, or $131.81 billion, of the market. Although private student loans make up a relatively small portion of total student debt outstanding, they have seen strong growth over the past decade. While federal student loan originations decreased by more than 25 percent between the 2010-11 and 2018-19 school years, the annual volume of private student loan originations increased by nearly 78 percent during the same period. In fact, the growth in outstanding personal loan balances between 2008 and 2019 was higher than that of almost every other consumer financial product, including auto loans, credit card balances and mortgages. At the end of 2019, outstanding private student loan debt was 71 percent higher than a decade earlier.

Delinquency Vs. Default: What’s The Difference?

Students can obtain student loans through the federal student loan program or through private credit providers. Often, federal loan borrowers also use private loans as a way to cover costs beyond federal loan limits. Unlike federal student loans, private student loans usually require a credit check during the application process. Private student loan lenders generally have more flexibility and discretion than federal agencies and can offer borrowers terms and rates depending on their credit history.

Using the Survey of Consumer Finances, we plotted the distribution of interest rates on private and federal student loans in 2019 (

). While both federal and private student loans in this sample had comparable rate spreads, it’s worth noting that federal student loans have a fixed interest rate for the term of the loan, while a private loan may have a variable interest rate students.

There are some large lenders such as Sallie Mae and Navient that focus primarily on student loans (

Pros And Cons Of Student Loan Consolidation For Federal Loans

). Other active participants in this market include banks such as Wells Fargo and Discover, which include private student loans in their entire portfolio of consumer financial products. However, a large portion of the market is made up of smaller entities such as fintech companies and private education lenders outside of banks, among others. Together, these small entities hold nearly a third of the private student loan market in terms of outstanding loan balance.

Private student loans are also packaged into Student Loan Asset Backed Securities (“SLAB”). SLABs help diversify lending risk by bundling loans into securities and providing different investment options to investors with different risk appetites. Figure 4:

Shows that the largest issuers in the private student loan market have issued approximately $15 billion worth of new private SLABs.

When it comes to delinquency and default, there are significant differences between private and federal student loans. First of all, private student loans are usually much less forgiving when payments are missed. Federal student loan programs allow a grace period of nine months for missed payments, but private student loans can be delinquent when a payment is missed.

Federal Vs. Private Student Loans: What’s The Difference?

In addition, federal student loan borrowers may have many options that allow them to get out of delinquency, such as loan rehabilitation and loan consolidation. Such options are generally very limited for borrowers with private student loans. Many private lenders will close a loan after 120 days of missing payments, leaving the door closed to borrowers trying to negotiate a training agreement. In addition to more loan training options, federal loans also have deferment, income-based repayment and loan forgiveness programs not typically offered by private lenders.

Finally, when borrowers default, the government usually has many means of recovery, including garnishment of wages and seizure of tax refunds. Private lenders often rely on lawsuits as a primary collection tool.

Recently, delinquency and private student loan defaults have been low. During the COVID-19 pandemic, lenders’ proactive efforts to provide borrowers with unity agreements are more likely to result in low default rates. Figure 5:

It provides an overview of the state of student loans in the first quarter of 2020. About five percent of private student loans were in default, more than double from the last quarter of 2019, during which time loans were used about two percent.

Exposing The Student Loan Racket (infographic)

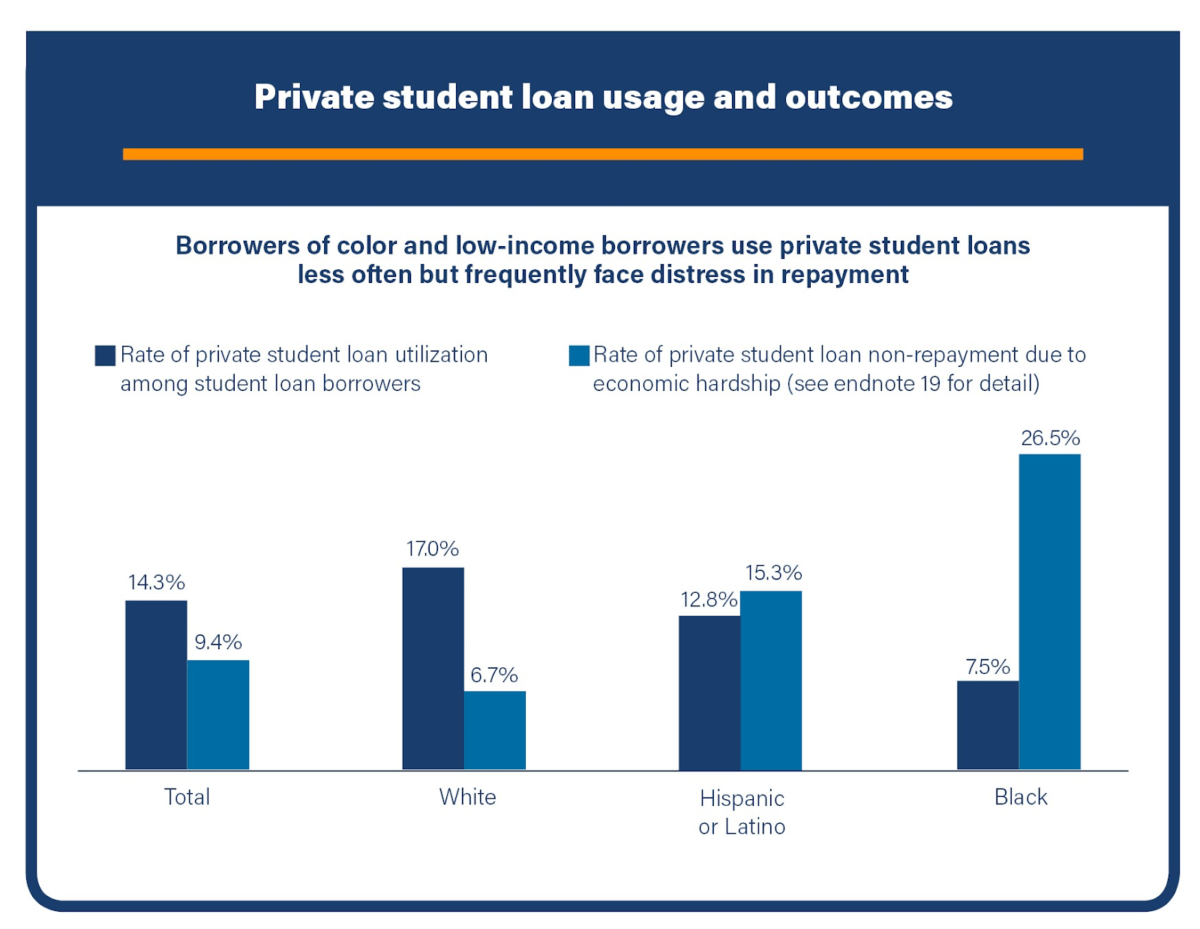

As part of the government’s COVID-19 relief efforts, federal student loans were put on interest-free relief from March 2020 through at least January 2021. In the case of private student loans, servicers have implemented various measures to accommodate borrowers who may be struggling to make ends meet. payments due to reasons related to COVID-19. For example, some private student loan providers waive late fees for a period of time, extend their financial aid, or automatically grant a one- to two-month grace period upon the borrower’s request. Media Domino: Student Debt Blog, How Private Student Loans Perpetuate Racial Disparities in the Student Loan Market

Nationwide, approximately 45 million borrowers have a combined loan debt of $1.7 trillion, including more than $140 billion in private student debt. Private student loans – made by banks and other private lenders without the involvement of the federal government – are taking on an increasing role in the broader student loan market, ie.

Consolidate defaulted private student loans, consolidation defaulted loan student, defaulted private student loan solutions, defaulted on student loan, defaulted private student loan help, refinance defaulted student loan, rehab defaulted student loan, defaulted private student loans, student loan defaulted, defaulted student loan help, defaulted student loan forgiveness, pay defaulted student loan