Default Private Student Loan Informational, Commercial – Most of our previous discussions of student loan debt levels and defaults used static measures of payment status. But it is instructive to consider the borrowers’ experiences rather than the life of the student loan. In the second post in this three-part series on student loans, we use the Consumer Credit Panel (CCP), itself based on Equifax credit data, to generate cohort default rates (CDRs) similar to those produced by the Department. education, but get out of your three-year window. We find that default rates continue to rise after three years and that performance deteriorates in the years preceding the Great Recession.

To construct cohort default rates, we first need to collect a history of default experiences at the borrower level. First, we identify a subset of borrowers that are 270 or more days past due. We then identify borrowers who have

Contents

- Default Private Student Loan Informational, Commercial

- Student Loan System Presents Repayment Challenges

- Student Loan Default: What It Is And How To Get Out

- Should I Pay Off Student Loans With A Home Equity Loan?

- Designed To Fail: Effects Of The Default Option And Information Complexity On Student Loan Repayment

- Is Private Student Loan For Debt Settlement A Good Strategy?

- Loan Pricing I Finance Course I Cfi

- Student Loan Default Ppt Powerpoint Presentation Visual Aids Show Cpb

Default Private Student Loan Informational, Commercial

Defaults In the fourth quarter of 2014, 11 percent of all borrowers were in default, and an additional 7 percent of borrowers had previously defaulted. Another 6 percent of borrowers were in the early stages of delinquency but had not yet been identified; Fully 37 percent of borrowers had at least one default on their credit report.

Student Loan System Presents Repayment Challenges

We then assign our borrowers to partners using the original loan data for the academic year in which the student stopped taking out new loans. This information allows us to assign each borrower to a “Major Completion Group” for each academic year. Our data do not provide information on graduation or withdrawal dates, but to the extent that student loan borrowers take out new loans in their final year of schooling, this approach provides a sample for each student loan borrower’s dropout cohort. Be close to the idea. Please note that our measures include Federal Plus and Perkins loans as well as private loans.

Now we can create default values by breaking down this equation. In our calculations, the number of borrowers is the number of borrowers who entered repayment in a given year, and the number is the number of borrowers in that group.

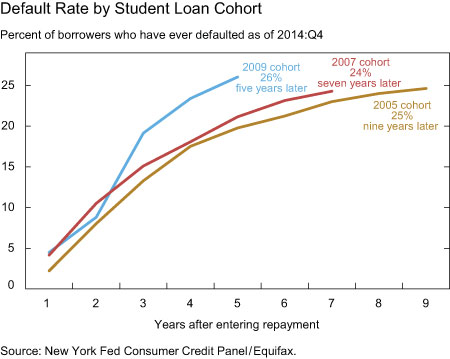

After defaulting on the loan, they began repayment. The chart below shows our calculations for the 2005, 2007 and 2009 cohorts. Compared to the fourth quarter of 2014, almost a quarter of each group remained insolvent. Note that the default rate has grown much faster in 2009 than in previous counterparts. Indeed, the chart shows a clear deterioration in cohort default rate schedules over time. The CDRs of the newer bonds are higher in all periods, with the only exception being the 2009 two-year default rate. However, this exception should be interpreted with caution as it was the only data point affected by unequal credit reporting in 2011.

Note that we have not seen the full picture of 2009 borrowers who default. Our calculations show a three-year default rate of 19 percent for this 2009 cohort; But after two years, another 7 percent of borrowers have defaulted. The pattern of previous cohorts strongly suggests that this rate will continue to rise. We had a three-year default rate of 13 percent in 2005, but that’s only half the default rate we see nine years later.

Student Loan Default: What It Is And How To Get Out

CCP data shows delinquencies are worse among borrowers with lower balances, and so are default rates. The results for the 2009 cohort, shown in the chart below, are striking: the highest default rates, nearly 34 percent, are among borrowers who owe less than $5,000. These borrowers make up 21 percent of the 2009 cohort. The default rate for borrowers who leave school with more than $100,000 in debt is nearly 50 percent lower, at 18 percent.

Our analysis of the borrower’s problem reveals some new facts. Perhaps most importantly, cohort default rates tend to worsen over time, and the two- and three-year analyzes that fuel much of the public debate are only part of the story. CDRs last from four to nine years. Second, the shortfalls appear to be concentrated among borrowers with low balances who may not have completed schooling or have obtained credit with wages lower than a four-year college degree. Finally, pictures of crime and default rates miss the fact that many borrowers today were seriously stressed in the past. Only 63 percent of borrowers appear to avoid delinquency and default.

In the next post, we’ll discuss how quickly these borrowers pay off their balances. We find that many borrowers who have defaulted on their debts are still struggling to pay their debts.

The views expressed in this post are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of New York or the Federal Reserve System. All errors or omissions are the responsibility of the authors.

Should I Pay Off Student Loans With A Home Equity Loan?

Metta Brown is a senior economist in the Research and Statistics Group at the Federal Reserve Bank of New York.

Joel Scully is Director of the Microeconomics Data Center in the Bank’s Research and Statistics Group.

Liberty Street Economics offers insights and analysis from New York Fed economists who work at the intersection of research and policy. Launched in 2011, the blog takes its name from the bank’s headquarters at 33 Liberty Street in Manhattan’s financial district.

The editors are Michael Fleming, Andrew Howett, Thomas Kiltegard and Asani Sarkar, all economists at the Bank’s Research Group.

Designed To Fail: Effects Of The Default Option And Information Complexity On Student Loan Repayment

The views expressed are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of New York or the Federal Reserve System.

Balance of Payments Bank Capital Bank Central Bank Climate Change Corporate Finance Financing COVID-19 Facilities Credit Crisis Cryptocurrencies Demographics DSGEE Economic History Education Employment Stocks Growth Eurozone Exchange Rates Funded Funded Debt Financial Markets Fiscal Policy Forecast Yes, Economist! Historical Decimals Domestic Finance Housing Human Capital Inequality Inflation Global Economy Labor Markets Lender of Last Resort Macroeconomics Monetary Policy New Jersey New York Banks Regent and Regent Bank of Reign sisRegulationRepoStocksStudent Loan Supply Chain Systematic Risk RatesTreasury

We encourage comments and questions about your posts and publish them (under the post) according to the following guidelines:

Please note: Comments made immediately before or during the FOMC blackout may not be published after the blackout.

Is Private Student Loan For Debt Settlement A Good Strategy?

Be relevant: Comments will be moderated and not displayed until they have been reviewed to ensure they are original and clearly related to the topic of the post.

Be Respectful: We reserve the right not to post comments or to post offensive, harassing, obscene or commercial comments. No word on whether a submission will be made or not

Comments with links: Please do not include any links in your comments, even if you think the links will contribute to the discussion. Comments with links will not be posted.

LSE Editors ask authors to submit a blog post to certify that they have no conflict of interest as defined in the American Economic Association’s Disclosure Policy. If the author has sources of financial support or other interests that may affect the research presented in the post, we will disclose this fact in a statement prepared by the author, which is attached to the author information at the end of the post. If the author is not interested in publishing, the statement will not be made. Please note, however, that in all cases we indicate whether the data seller or another party has the right to review the post. In July 2021, a federal court ruled that private student loans can be discharged in bankruptcy. But student loan refinancing can provide a better way to manage your college debt without significantly damaging your credit score. (iStock)

Loan Pricing I Finance Course I Cfi

Bankruptcy is a legal process that provides financial assistance to consumers who are unable to repay their debts. Many types of debt can be discharged in bankruptcy, including credit card debt and medical debt. However, certain types of education benefits, such as federal student loans, cannot be discharged in bankruptcy.

In previous bankruptcy cases, it was unclear whether private student loans were dischargeable loans — until July 2021, a federal court ruled that private student loans were among the largest discharges under the U.S. Bankruptcy Code. Education is not considered an eligible cost.

Personal loans in bankruptcy can provide much-needed relief to debtors who cannot pay their debts, but bankruptcy has a lasting impact on an individual’s finances and credit score. It is important to consider alternatives before filing for bankruptcy.

If you’re having trouble paying off your personal student loans, refinancing may be the answer. By refinancing your college loans at a lower interest rate, you may be able to lower your monthly payments to avoid defaulting on your loans.

Student Loan Default Ppt Powerpoint Presentation Visual Aids Show Cpb

Private student loan refinancing rates are near historic lows. Get pre-approved for a Credible student loan refinance to lock in your interest rate.

Bankruptcy law prevents certain types of debt from being discharged during bankruptcy proceedings, including debt incurred as part of an “educational grant.” But according to the July 2020 ruling, private student loans do not fall into this category.

A federal bankruptcy court in New York ruled in favor of a debtor who discharged private student loans issued by Navient.

Student loan default lawyer, student loan default forgiveness, private student loan default consequences, private student loan default help, student loan default rehabilitation, student loan default help, student loan default, default on private student loan, private student loan default rate, private student loan default options, private student loan default, private student loan default settlement