Default On Private Student Loans Informational – Lexington Law offers free credit repair counseling that includes a full review of your free credit report summary and score. Call us today to take advantage of our duty free offers.

The information on this site does not exist and is not intended to act as legal, financial or credit advice. See the Lexington Law Editorial Presentation for more information.

Contents

- Default On Private Student Loans Informational

- Student Loan Repayment Guide

- Public Service Loan Forgiveness Gets Major Overhaul

- What Happens If You Can’t Pay Your Student Loans?

- What Is Student Loan Deferment & How Does It Work?

- Understanding Federal Student Loan Repayment Options

- What Happens If A Cosigner On A Student Loan Dies?

- The Ins And Outs Of Student Loans

- The New Student Loan Repayment Plan: Save

Default On Private Student Loans Informational

Outstanding student loan debt totals more than $1.7 trillion, with an average of $37,787 owed on one loan. An estimated 43.5 million Americans have some form of student loan debt. Source: Federal Reserve

Student Loan Repayment Guide

By 2023, student loan debt in the United States will total more than $1.7 trillion, according to the Federal Reserve. This includes federal student outstanding student loan balances as well as private loans.

To help you better understand student loan debt in the US and see how you compare, we’ve compiled the latest student loan debt statistics. We cover both federal and private student loan debt, where the state has the highest student loan debt, as well as debt by age group.

If you have student loan debt, you are not alone. Here’s a look at how much Americans are currently in student loan debt:

The burden of student loans is poised to have a lasting impact on graduate students as homeownership among Americans under 35 declines and the expected retirement age rises. With the rising cost of college tuition, it is important for graduates and borrowers for prospective students to implement a strategic financial plan to plan for future investments.

Public Service Loan Forgiveness Gets Major Overhaul

The US Department of Education provides an annual portfolio that documents how much Americans owe in student loans, both federal and private. Of the $1.7 trillion in outstanding student loan debt, $1.6 trillion is owed to the federal government. The analysis is as follows, according to the 2022 Q4 report:

Borrowing private money to pay tuition is a way many college students use to finance their schooling. Unlike government-sponsored Stafford loans, private loans tend to have higher interest rates and have none of the benefits of federal loan waivers and income-based payment programs.

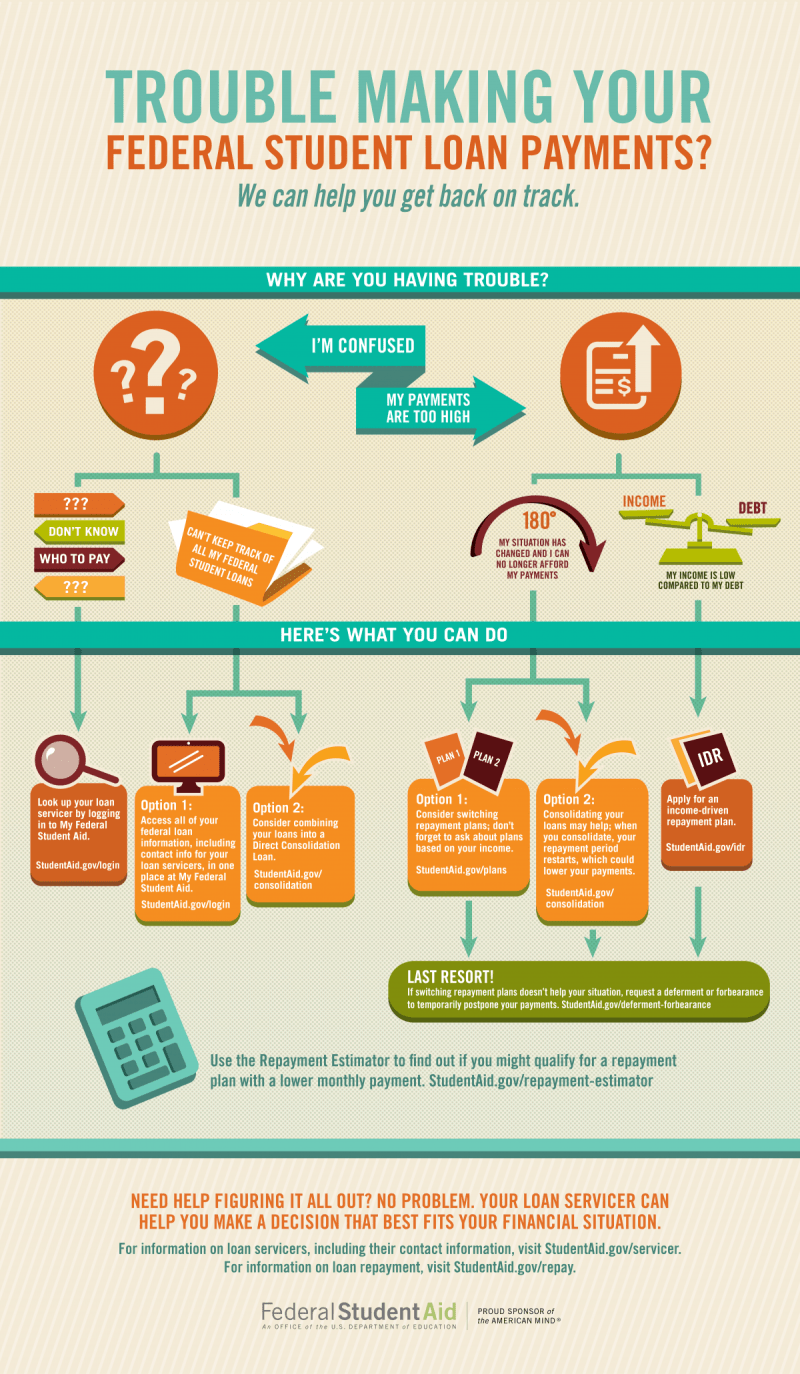

Borrowers who are unable to make their payments can apply for a forbearance or forbearance, both of which are ways to postpone loan payments. It is important to remember that during this time interest rates can still rise.

The following is data from Q4 2022 from the US Department of Education monitoring the loan repayment status:

What Happens If You Can’t Pay Your Student Loans?

Analyzing student loan borrowers by age demographics can be helpful in understanding the financial situation of Americans. According to the Pew Research Center, 34% of all student loan borrowers are under the age of 30, and about 22% are between the ages of 30 and 44.

The US Department of Education reports the following for total student loan debt broken down by the total amount owed by age group, as well as the number of Americans in each group:

Borrowers will not lend money if the payment is later than 270 days. Missing and defaulting on student loan payments can have a serious impact on your credit score and can create barriers when applying for insurance and financing schemes, as well as finding housing and loans.

There are many public and private programs that offer student loan debt relief. These programs pay off some of your debt and often require you to meet certain criteria that vary by program.

What Is Student Loan Deferment & How Does It Work?

The most common program is the government’s Federal Public Service Loan Program (PLSF). As of October 2022, they reported:

According to the Education Data Initiative, only 2.16% of all PSLF applicants will be approved by 2020. In addition to incomplete forms, 35% of the forms have not yet been processed. They also reported that only 6.7% of borrowers were eligible to apply.

The cost of education is not the same in the United States. As universities receive state-level funding and the cost of living changes across the country, the location of college graduates will affect their financial performance.

According to Experian, student loan debt in the United States has increased every year since 2009 and is growing faster than inflation.

Understanding Federal Student Loan Repayment Options

Student loan refinancing is an option for borrowers to lower interest rates and monthly payments, but this also extends the term of the loan.

Student debt consolidation is for those with multiple loans. This allows the borrower to integrate the loan into one sum by “consolidating” it.

The Education Data Initiative reports that it takes borrowers an average of 20 years to repay their student loan debt.

Borrowing large amounts of money can affect your credit score. Payment history is a major contributor to your credit score, which can drop quickly if you don’t pay. Hopefully these student loan debt statistics will help you see where you stand compared to other Americans. If you are unsure whether a student loan has a negative impact on your credit score, let Lexington Law provide you with free credit photos and consultations to evaluate your student loan and other credit factors. More.

What Happens If A Cosigner On A Student Loan Dies?

Articles are reviewed by certified attorneys, not by them. The information provided on this site does not constitute and is not intended to act as legal, financial or credit advice. Instead, it is for general information purposes only. Use and access to this site or any links or resources contained in this site do not constitute a solicitation – client or relationship between readers, users or browsers and website owners, authors, reviewers, contributors, employees or respective agency or employer.

Paola Bergauer was born in San Jose, California, then moved with her family to Hawaii and later to Arizona.

In 2012, she received a bachelor’s degree in psychology and political science. In 2014, she graduated from Arizona Summit Law School with her PhD. During her law degree, she had the opportunity to participate in externships where she was able to represent clients seeking asylum in immigration court. Paola is also a senior staff writer at her law school’s Law Review. Prior to joining Lexington Law, Paola worked in the Immigration, Crime Prevention and Personal Injury Division. Paola is licensed to practice in Arizona and is an associate attorney in the Phoenix office. US student loan debt has now reached $1.6 trillion this year, and as it continues to grow, many college graduates are concerned that they may not be able to repay their debt. More than 44 million Americans are in student debt, and the average graduate in the United States owes about $40,000 each.

Recent upheavals in politics have focused on the student debt crisis. Elizabeth Warren introduced a bill titled the Student Loan Debt Relief Act of 2019. The bill establishes a plan that will eliminate more than 95% of borrowers’ student loan debt and completely eliminate student loan debt for more than 75% of Americans. With student loan debt.

The Ins And Outs Of Student Loans

These statistics can be a bit abstract, so to get a good idea of what this means, here are some data and pictures of the US student debt crisis.

This data sheet from HowMuch shows the debt burden the United States faces by state. Dark states indicate more debt. The numbers are calculated by dividing the total outstanding student debt held by registered citizens in each state by the total number of registered citizens in the state. The vision puts the amount of debt in the entire country into perspective, making it clear that Columbia’s student debt is more than twice the national average higher than in other states. In contrast, Wyoming, Hawaii and West Virginia have the lowest student loan debt per capita.

This infographic shows the staggering amount of student debt in the country. The total reached $1, 011, 654, 459, 649. With 37 million Americans who owed a student loan, 27% of that amount is behind payments. This infographic shows the crisis many people face in not repaying their student loans after graduation.

To put the numbers in perspective, this shows a comparison of student debt and tuition compared to what you can buy with that amount of money. Putting it into perspective, like paying off a mortgage on a new car or starting your own business, can really show how increasing debt affects people by preventing them from buying finance for their future. of student loans.

The New Student Loan Repayment Plan: Save

This chart from Vox shows the cost of college per year from 1970 to 2010. As shown in the chart, college expenses in the 1970s started at just under $10,000. The graph shows an increase until 2010, rising to more than $20,000. The current cost of college per year now in 2019 is $34,740. Tuition does not include housing, books, transportation, and many other essentials associated with going to college.

To provide a better understanding of visual data before ascent

Can you default on private student loans, how to get private student loans out of default, what happens if you default on private student loans, default on private student loan, student loans and default, default on private student loans, default on student loans, consolidate student loans default, can i default on private student loans, default private student loan, student loans default, bankruptcy on private student loans