Kabbage Loan American Express – By Penny Crosman CloseText About Penny twitter pennycrosman?lang=en mailto penny.crosman@arizent.com linkedin pennycrosman August 18, 2020, 3:35 p.m. EDT 8 Minutes Read

American Express is buying a “significant amount” of online lender Kabbage, but not its loan portfolio. So what does it get?

Contents

- Kabbage Loan American Express

- Kabbage Funding: Amex +3 Small Business Alternatives [2023]

- Hundreds Of Ppp Loans Went To Fake Farms In Absurd Places

- Why Amex Is Buying Kabbage

- It’s Official: American Express Is Acquiring Kabbage

- Business Cash Flow Dashboard

- American Express To Acquire Kabbage

- American Express Retires The Kabbage Brand With The Launch Of Business Blueprint

- American Express Buys Kabbage In Push For Small Business Customers

- Amex, Already Small Business Card King, Wants More With Kabbage

Kabbage Loan American Express

American Express could use Kabbage’s software and talent to offer a range of small business services that would rival any other bank, observers said.

Kabbage Funding: Amex +3 Small Business Alternatives [2023]

“It makes sense for American Express because it allows them to bring in an additional powerful technology and related technology team at a reasonable price rather than building that and hiring organically,” said Sam Kilmer, managing director of Cornerstone Advisors. “American Express is already one of the largest small business lenders in the country, so it allows them to spread the use of that technology to a larger customer and prospect base.”

Amex did not say it was paying for Kabbage, although recent reports said the lender could be worth as much as $1 billion following SoftBank’s $250 million investment.

The technology created by Kabbage is a lending platform that collects data about small business borrowers, including bank account data, payment processing data, social data, shipping data, credit card transaction data and information of accounting.

Amex says it doesn’t plan to make any wholesale changes to Kabbage. “For now, the Kabbage brand, and digital platform will continue to exist and will be led and operated by Kabbage’s current leadership team,” a spokesperson said.

Hundreds Of Ppp Loans Went To Fake Farms In Absurd Places

“All of this data gives us unique insight into the performance of the business,” said Kathryn Petralia, co-founder and president of Kabbage, in an earlier interview. “This enables the user experience we have today, which is a much faster sign-in process.”

Kilmer said the fact that Amex is acquiring a team with technology and not the loan portfolio itself speaks to the value of the technology itself.

“This is not a market share grab or an incremental acquisition,” he said. “It’s about intellectual property, when to sell it and its impact on capacity.”

Indeed, in a research note to investors published Tuesday, Keefe, Bruyette & Woods analyst Sanjay Sakhrani said the plan would have little impact on Amex’s earnings in the near term.

Why Amex Is Buying Kabbage

However, in the long run, this could give Amex an edge over other lenders. Being competitive in small business lending, like consumer lending, requires the ability to make decisions on the fly, Kilmer said.

Kabbage’s data-driven automated lending platform gives it an edge over others in the small business lending space, according to Kathryn Petralia, co-founder and chief operating officer of Kabbage.

“This is where credit card lenders like American Express and Capital One shine and where fintechs like OnDeck and Kabbage shine,” he said. “Credit card lenders have excelled at data analytics while online lenders like Kabbage and OnDeck have excelled at user interface and user experience. That’s because credit card lenders need robust analytics to capitalize on profits and insights while online lenders Online companies like Kabbage and OnDeck need to excel in user experience to win over customers and investors. Give them a try.”

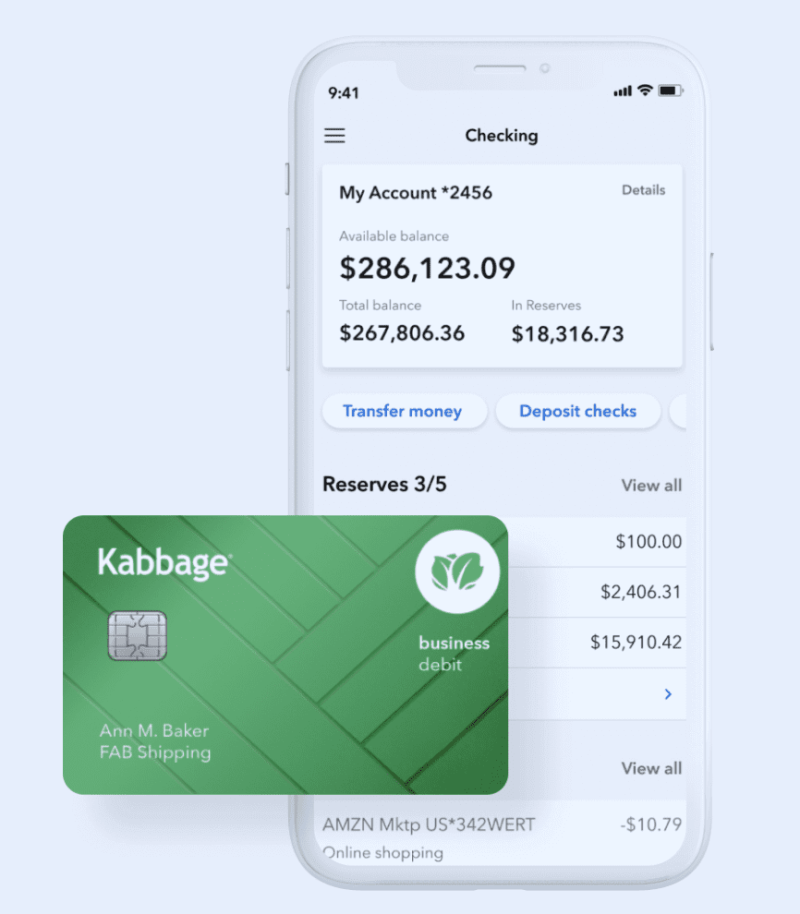

The company already offers debit and credit cards and other short-term business financing products, and with Kabbage’s technology, “we can meet the needs of small businesses that may feel underserved by banks and have little understanding of management tools.” financial services that provide insights and information about their spending and finances,” the company said in a news release announcing the plan.

It’s Official: American Express Is Acquiring Kabbage

“American Express doesn’t really want Kabbage’s existing business,” said Todd Baker, managing director of Broadmoor Consulting and senior fellow at Columbia University. “It wants the ability to originate small business loans seamlessly, cheaply and efficiently. It wants the writing skills that exist in Kabbage’s lending principles and data. It’s important to leave behind and start over on all the things that really matter.” American Express and Kabbage told the Financial Times that they will set up and fund an entity that will service all of Kabbage’s outstanding loans, and that borrowers will not be affected.

“We are excited about Kabbage’s suite of products being integrated into an online platform that uses real-time data processing to help small businesses better understand, forecast and manage their cash flow,” said an Amex spokesperson.

Which helps small businesses connect with influencers and gig workers. American Express Ventures is one of its backers.

In October, Kabbage created a payment service, Kabbage Payments, that allows small businesses to create and send invoices to customers and create a URL where they accept card payments through Kabbage for a 2.25% fee per purchase. Fifth Third Bancorp sponsors the service.

Business Cash Flow Dashboard

To its customers which can be paid within three days. (Until then, it offered loan terms of six, 12 or 18 months.) This is a response to the fact that often, companies pay off loans early.

The Kabbage team has also developed a suite of credit capabilities and dashboards that small businesses can use to track their cash flow.

Kabbage co-founders Petralia and Rob Frohwein created a good and bad start-up that quickly grew. They are also open and passionate influencers, insisting for years that credit scores are an outdated way of assessing credit quality and that alternative types of data, including cash flow, provide a better view of small business performance and value. .

Both are expected to join Amex when sales close later this year. “Everyone at Kabbage will be joining Amex, including Rob and Kathryn,” a Kabbage spokesperson said.

American Express To Acquire Kabbage

Baker said that often in cases like this, executive contracts are written only to receive their full equity-linked compensation if they stay with the company for a set period of time.

Transforming an independent company into a large corporation with assets of $198 billion is undoubtedly a challenge.

In the big bank where Baker once worked, small companies were bought, “when they were brought into motherhood, the normal change was crushed because it didn’t fit with what the bank was doing. I called the disruption to the village to save it.”

However, at this time, Amex is not planning any wholesale changes. “For now, the Kabbage brand, and digital platform will continue to exist and will be led and operated by Kabbage’s current leadership team, all part of the American Express Company,” the spokesperson said.

American Express Retires The Kabbage Brand With The Launch Of Business Blueprint

It’s no coincidence that American Express announced its plan for Kabbage shortly after Enova said it had agreed to buy Kabbage’s main rival, OnDeck Capital.

Kabbage and OnDeck’s core business is originating and securing small business loans. (In Kabbage’s case, the loans were made by Celtic Bank in Salt Lake City.) When the disease hit, Kabbage went bankrupt. Many of its borrowers went out of business and had to stop lending.

Handle new Small Business Administration loans. It has made more than 300,000 small business loans totaling $7 billion, making it the second largest PPP lender in the country by application volume.

But the loans issued by Kabbage before the crisis are difficult to value today, and therefore difficult to sell.

American Express Buys Kabbage In Push For Small Business Customers

“While the performance has been incredibly good in small business loans, no one is sure if that is only because of government support and if that government support stops they will suddenly start to fall,” Baker said. “It is very difficult for the buyer and the seller to agree on the value of the loans. Everyone in small business realizes that being a lender will not survive, but if you can embed different financial products into a business model, which provides real value to customers. That’s why you see software providers, the Intuits of the world, getting into lending and payments.

“They were squeezed because they were using more cards, even though they did other types of installment loans and lines of credit,” he said. “They’re very focused on trying to make the American Express card itself acceptable to small businesses. It’s another way for them to offer more credit products and be a supporter of small businesses.”

“We’ve built a technology and data platform that gives them the kind of capabilities and insights that are often reserved for large enterprises,” he said in a Kabbage press release. “By joining American Express, we can help small businesses succeed with a complete digital ecosystem of financial products to help them run and grow their companies.”

“The lending style of the online marketplace is not good,” Baker said. “No one is making money. But the technology and the ability to make that lending put into a different business model in other hands” can work. Kabbage from American Express is an online platform for small business lending. It offers a wide range of financial solutions for small businesses including Kabbage Financing, Auditing and Payments.

Amex, Already Small Business Card King, Wants More With Kabbage

Kabbage offers business loans from $2,000 to $250,000 to borrowers with FICO scores of 640 and above. In short, we will also review online business checking account and payment processing services

American express buys kabbage, american express kabbage, american express kabbage funding, american express kabbage inc, kabbage loan, kabbage and american express, american express kabbage account, kabbage american express log in, american express kabbage loan, kabbage checking american express, kabbage from american express, kabbage by american express